Inflation Reduction Act

For Individuals and Homeowners

Tax Credits

-

Residential Clean Energy Tax Credit (25D)

Description: Tax credit for residential solar, solar water heating property, fuel cells, geothermal heat pump property, small wind energy property, qualified biomass fuel property, and adds qualified battery storage technology

Amount: 30% credit

Resources:

IRS Residential Clean Energy Tax Credit homepage

Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics - Department of Energy

Fact Sheet on Residential Energy Efficiency Tax Credit and the Nonbusiness Energy Property Credit - Rewiring America

-

Nonbusiness Energy Property Credit (25C)

Description: Tax credit on qualified energy property including but not limited to: water heaters, heat pumps, central air conditioners, hot water boilers, biomass stoves, oil furnaces, air sealing materials and systems, electrical panels, and the cost of home energy audits

Amount: 30% credit with a $1,200 annual limit

Resources:

Fact Sheet on Residential Energy Efficiency Tax Credit and the Nonbusiness Energy Property Credit - Rewiring America

-

Previously Owned Clean Vehicle Credit

Description: A credit for the purchase of a used electric vehicle at least 2 years old from a dealership

Amount: $4,000 credit per vehicle or 30% of the sale price, whichever is less

Resources:

Official guidance from the IRS on the Used Clean Vehicle Credit

List of qualifying vehicles:

More info on electric vehicle credits - from Rewiring America

-

Clean Vehicle Tax Credit

Description: A credit for the purchase of a new electric vehicle

Amount: Up to $7,500 credit per vehicle

Resources:

List of qualifying vehicles:

More info on electric vehicle credits - Rewiring America

-

§30C Alternative Fuel Refueling Property Credit

Description: A tax credit for electric vehicle charging infrastructure in low income or rural census tracts

Amount: 30% tax credit up to $1,000 per station for residential property and $100,000 for commercial property

Resources:

EV Charging Station Credits Article - National Law Review

-

§48E Clean Electricity Investment Credit

Description: Technology-neutral tax credit for investment in facilities that generate clean electricity and qualified energy storage technologies.

Amount: 6% of qualified investment (basis); 30% if PWA requirements met

Resources:

-

§45Y Clean Electricity Production Credit

Description: Provides a technology-neutral tax credit for production of clean electricity.

Amount: $0.03 cents/kW

Resources:

-

HOMES Rebate Program

Description: A rebate program for the costs of energy efficiency retrofits that are modeled to achieve or have achieved certain energy savings levels

Amount: The Hawai’i State Energy Office has been allocated $34,293,520 for this program

Funding Source: Hawai’i State Energy Office

Resources:

-

High Efficiency Electric Home Rebate Program (HEEHR)

Description: To provide rebates for qualified home electrification upgrades

$8,000 for heat pump heating, ventilation and air conditioning (HVAC)

$1,750 for heat pump water heater

$840 for an electric stove/cooktop

$2,500 for electric wiring

$4,000 for breaker boxes

$1,600 for weatherization (insulation, air sealing, ventilation)

Amount: The Hawai’i State Energy Office has been allocated $34,093,900 for this program

Funding Source: Hawai’i State Energy Office

Resources:

Key Resources

-

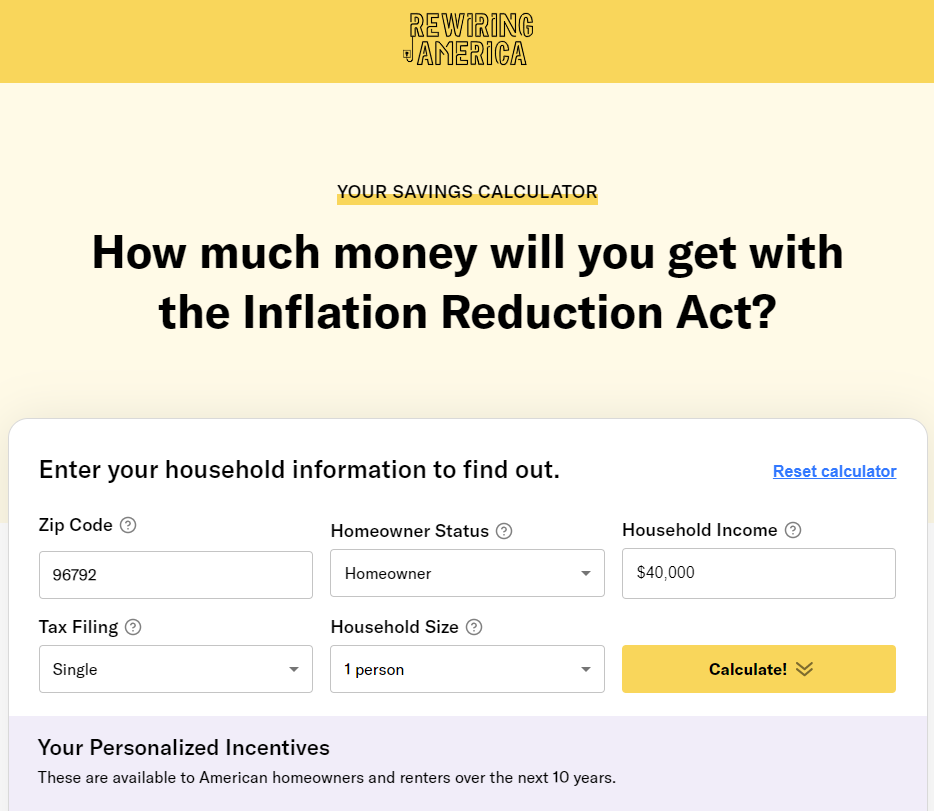

Check out this calculator to determine how much money you could save with the Inflation Reduction Act, from Rewiring America

-

For a more in depth look into how to maximize IRA savings and start building your electrification plan today, take a look at this “Go Electric” Guide to the IRA, from Rewiring America

Please note, the Inflation Reduction Act is new and information is constantly evolving. This page will be continuously updated as more information is released.